Case Interview: Complete Prep Guide for Beginners (2026)

Author: Taylor Warfield, Former Bain Manager and Interviewer

Published: January 27, 2026

Case interviews are the biggest hurdle standing between you and a consulting offer. They're unlike any other interview format. You can't wing them. And most candidates don't prepare effectively.

This case interview guide changes that.

We've compiled everything you need to prep for case interviews into one comprehensive resource. You'll learn what case interviews are, how they're evaluated, and exactly how to prepare for case interviews. We cover the major frameworks, the math you'll need, and the skills that separate good candidates from great ones.

But case interviews aren't the whole picture. You'll also face behavioral questions, fit assessments, and sometimes pre-screening tests. We cover all of it.

Whether you have one week or three months to prepare, this guide gives you a clear path forward. By the end, you'll know exactly what to expect and how to perform at your best.

But first, a quick heads up:

Learning case interviews on your own can take months.

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in my case interview course and save yourself 100+ hours. 82% of my students land consulting offers (8x the industry average).

Table of Contents

- What is a Case Interview?

- Types of Case Interviews

- Case Interview Process

- Case Interview Frameworks

- Case Interview Math

- Other Case Interview Skills

- Case Interview Examples with Solutions

- Case Interview Preparation Plan

- First Round vs. Final Round Case Interviews

- Case Interview Resources

-

Beyond the Case Interview

What is a Case Interview?

A case interview is a 30 to 60 minute exercise where you and an interviewer work together to solve a business problem. Think of it as a mini consulting project crammed into a single conversation.

These business problems mirror real challenges that companies face every day:

- How can Amazon increase its profitability?

- What should Tesla do to price its new electric vehicle?

- Should Disney open another theme park?

- How can Netflix improve customer retention?

Case interviews simulate what you'll actually do as a consultant. Many cases are based on real projects that interviewers have worked on. While actual consulting engagements last 3 to 9 months, case interviews compress that problem solving into less than an hour.

You're not just answering questions. You're collaborating with the interviewer, asking them questions, walking them through your thinking, and building toward a recommendation together.

Cases can cover any industry, from healthcare to technology to retail. They can focus on any business situation, whether that's entering a new market, launching a product, or turning around a struggling company.

The good news? You don't need specialized knowledge to solve them. Unless you're interviewing for a firm that focuses on a specific industry, cases are designed so anyone with general business knowledge can crack them.

Why Consulting Firms Use Case Interviews

Consulting firms use case interviews as part of consulting interviews because they're the best predictor of who will actually succeed as a consultant. Not perfect, but pretty close.

Since cases simulate the consulting job, interviewers can see how you'd perform as a hypothetical consultant. The skills you need to crush a case interview are the same skills you need to deliver great work for clients.

Case interviews also work as a test for fit. If you find cases interesting and energizing, you'll probably enjoy consulting. If you find them tedious and boring, this might not be the right career path for you.

Expect case interviews to show up in every management consulting interview.

What Skills Case Interviews Assess

Case interviews evaluate five key qualities:

- Logical, structured thinking: Can you break down complex problems into simpler pieces? Can you sift through mountains of data and pull out what actually matters? Can you draw reasonable conclusions from the evidence?

- Analytical problem solving: Can you read and interpret information accurately? Can you do math calculations smoothly without getting flustered? Can you run the right analysis to reach the right conclusions?

- Business acumen: Do you understand fundamental concepts like profit, market share, and competitive advantage? Do your conclusions make sense from a business perspective?

- Communication skills: Can you explain your thinking clearly and concisely? Are you articulate when presenting your ideas?

- Personality and cultural fit: Are you coachable? Easy to work with? Pleasant to be around?

Since case interviews can assess so many different qualities among candidates, they are a very important part of the consulting interview process.

Case Interview Success Statistics

Case interviews are tough. Roughly 40 to 50 percent of candidates pass their first-round case interviews. That number drops to 20 to 30 percent for final-round case interviews. Overall, only 8 to 15 percent of candidates pass all of their case interviews.

Types of Case Interviews

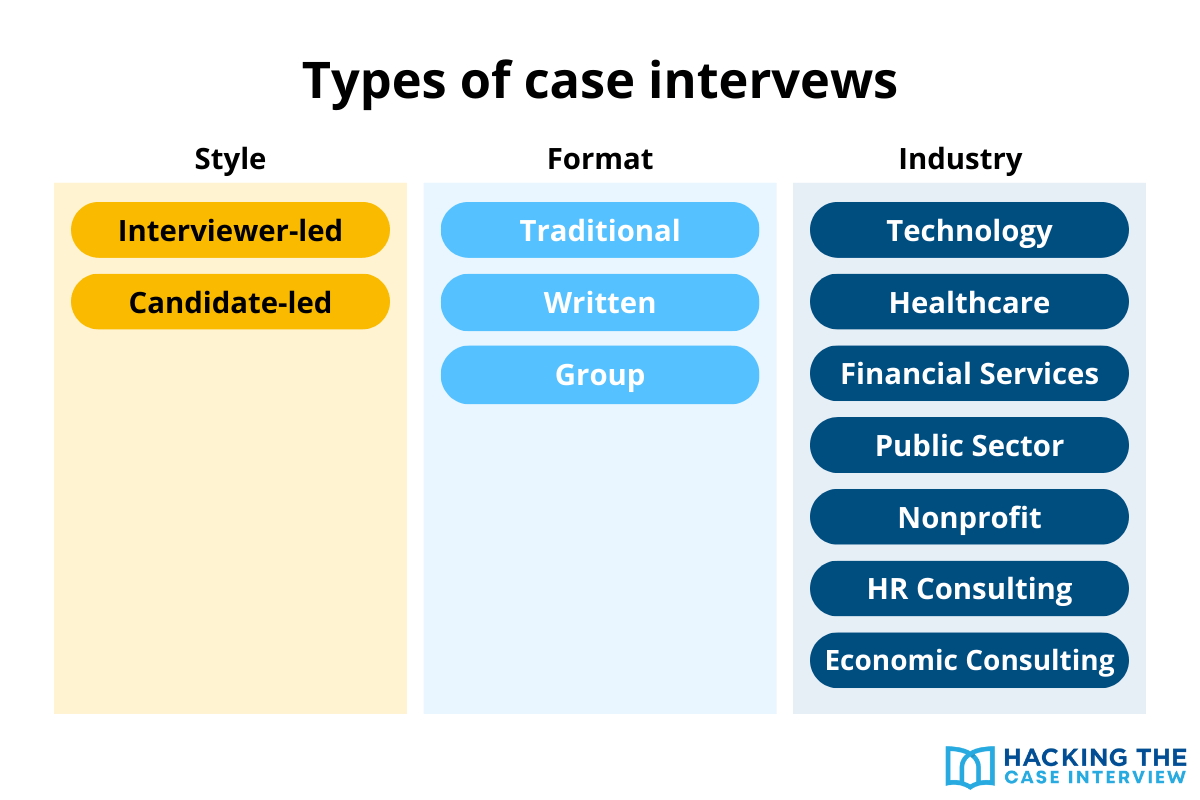

Not all case interviews work the same way. As part of this comprehensive case interview guide, understanding the different formats helps you prepare for exactly what you'll face on interview day.

Candidate-Led Case Interviews

In a candidate-led case interview, you're in the driver's seat. You decide which areas of your framework to explore, what questions to answer, what analyses to run, and what the next step should be.

The interviewer provides the initial business problem and answers your questions along the way. But they won't tell you what to do next. That's your job.

If you go down the wrong path, the interviewer will gently steer you back on course. But you're expected to proactively drive the case forward without waiting for instructions.

This format requires you to check in with the interviewer frequently. After proposing your next step, ask if your approach makes sense. This ensures you're heading in the right direction and demonstrates your collaborative nature.

Listen carefully to subtle cues from the interviewer. Do they look confused by your approach? Do they seem to agree with your direction? These signals help you adjust on the fly.

Interviewer-Led Case Interviews

In an interviewer-led case interview, the interviewer controls the direction and pace of the case. They have a specific list of questions they'll ask you to work through.

After you present your framework, the interviewer will direct you to specific areas they want you to explore. Once you answer one question, they'll point you to the next one.

You still need to think critically and solve problems. The difference is that you're not expected to decide what to investigate next. The interviewer has already mapped out the journey.

This format requires you to follow directions carefully. Don't try to deviate from the path the interviewer has set for you. You won't earn bonus points for going off script.

Industry-Specific Case Interviews

Some consulting firms specialize in particular industries and will give you cases tailored to those sectors. Here's what to expect across the most common specializations.

Technology Consulting Case Interviews

Technology consulting case interviews focus on how companies use technology to become more productive and profitable. You might be asked to decide whether a company should buy or build a technology solution, evaluate different vendors, or determine whether to develop technology in house or outsource it.

Firms like Accenture and Cognizant use these cases. If you're interviewing for a senior role, expect more technical questions. Entry level candidates typically face cases that require general business knowledge rather than deep technical expertise.

Healthcare Consulting Case Interviews

Healthcare consulting case interviews can cover any part of this massive industry. That includes pharmaceutical companies, medical device manufacturers, insurance providers, and hospital systems.

You might be asked to help a drug company price a new medication, assess whether a hospital should expand into a new service line, or evaluate a potential acquisition of a biotech startup.

Familiarize yourself with the basic stakeholders in healthcare, including patients, providers, payers, pharmaceutical firms, and government regulators. Understanding how these groups interact will help you navigate healthcare cases.

Financial Services Consulting Case Interviews

Financial services case interviews often involve banks, insurance companies, asset managers, or fintech startups. Common scenarios include improving profitability at a retail bank, evaluating a new product launch, or assessing risk management strategies.

You should understand basic financial concepts like return on equity, credit risk, and regulatory requirements. But entry level candidates aren't expected to have deep financial expertise.

Public Sector Consulting Case Interviews

Public sector case interviews focus on helping government agencies at local, state, or federal levels solve operational or strategic challenges. This can include everything from improving education systems to developing sustainable infrastructure.

You might work on cases involving economic development, public health, defense, climate action, or public finance. The key difference from private sector cases is that success is measured by social impact rather than profit.

Nonprofit Consulting Case Interviews

Nonprofit case interviews place you in scenarios facing charitable organizations, foundations, and NGOs. You might be asked how the American Red Cross can increase blood donors, or how a foundation should allocate its budget across different causes.

The business problems are similar to private sector cases, but the objectives differ. Instead of maximizing profits, you're often trying to maximize social impact while operating within constrained budgets.

Human Resources Consulting Case Interviews

Human resources case interviews present scenarios related to talent management, organizational development, and workforce challenges. You might be asked to design a leadership development program, address declining employee engagement, or develop strategies for improving diversity and inclusion.

These cases test your understanding of how people and organizational dynamics impact business results.

Economic Consulting Case Interviews

Economic consulting case interviews are different from traditional management consulting cases. They often involve litigation support, regulatory issues, or complex financial disputes.

You might be asked to estimate damages from intellectual property theft, prepare testimony for a legal case, or analyze whether competitors have engaged in price fixing.

Firms like Cornerstone Research, Analysis Group, and NERA use these cases. More senior roles may require specialized knowledge of economics, finance, or law.

Group Case Interviews

Group case interviews put you in a team of three to six candidates all competing for the same job. Your group receives case materials and has one to two hours to work together on a recommendation.

While you work, the interviewer observes your discussions without interfering. Once time runs out, your group presents your findings and answers follow-up questions.

These cases heavily emphasize teamwork. Interviewers evaluate whether you can make meaningful contributions, handle disagreement professionally, and bring out the best in other people. Being the loudest voice in the room won't help you. Neither will staying silent.

The goal is to demonstrate that you're both effective and pleasant to work with.

Written Case Interviews

Written case interviews give you a packet of information, typically 20 to 40 pages of charts, graphs, tables, and notes. You get one to two hours to analyze the data and create a short slide presentation.

You work alone. The interviewer leaves the room and returns when time is up to hear your presentation and ask follow-up questions.

Some written cases provide specific questions to answer. Others just give you the business problem and let you decide what to address.

This format tests your ability to quickly synthesize large amounts of information, identify what matters most, and communicate your findings clearly under time pressure.

Case Interview Process

Every case interview follows the same predictable structure. Once you understand the steps and how interviewers actually evaluate you, you’ll understand how to ace case interviews.

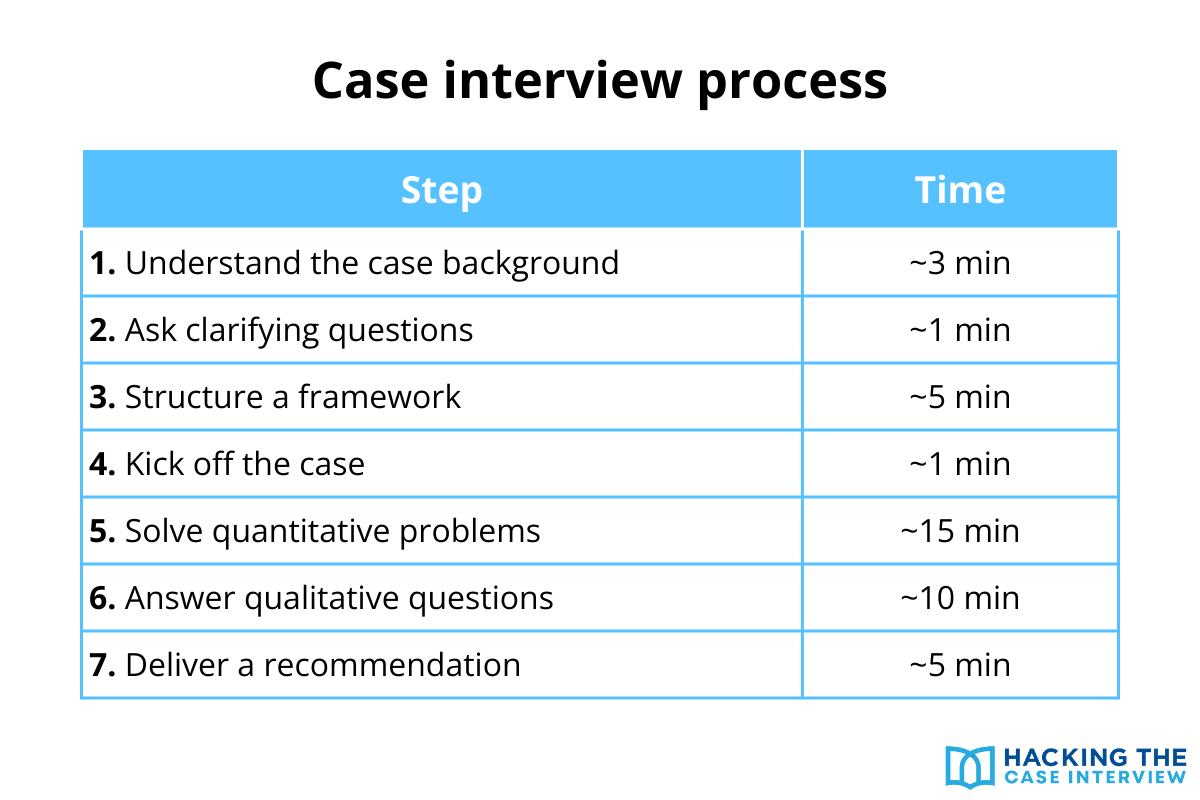

Case Interview Steps

Case interviews move through seven distinct phases. Mastering each one builds toward a strong overall performance.

Step 1: Understand the case background

The interviewer kicks things off by reading you the case background information. This typically includes details about the company, the industry context, and the business problem you need to solve.

Take notes while the interviewer speaks. Focus on capturing the company name, key numbers, and most importantly, the objective of the case. What question are you being asked to answer?

After the interviewer finishes, summarize the situation back to them in your own words. Don't parrot everything verbatim. Synthesize the key points concisely. This confirms you understood correctly and demonstrates that you can distill information quickly.

Verifying the objective is critical. Solving the wrong problem is the fastest way to fail a case interview.

Step 2: Ask clarifying questions

You'll have a chance to ask questions before diving in. Use this time wisely.

Ask questions that strengthen your understanding of the situation. Good questions might clarify the company's goals, define unfamiliar terms, or fill in missing context. Avoid questions that are too specific or premature for this stage.

Most candidates ask one to three questions here. You'll have opportunities to ask more questions throughout the case.

Step 3: Structure your framework

Ask for a minute or two to organize your thoughts. The interviewer will expect this.

A framework breaks the complex problem into smaller, manageable pieces. Think of it as your roadmap for solving the case. What are the three or four major areas you need to investigate to reach a confident recommendation?

Don't use memorized frameworks. Interviewers spot them immediately. Instead, build a custom framework tailored to the specific case in front of you.

Once your framework is ready, turn your paper toward the interviewer and walk them through it. Explain what areas you want to explore and why each matters for solving the case.

Step 4: Kick off the case

How the case proceeds depends on whether it's candidate-led or interviewer-led.

In a candidate-led case, you propose which area of your framework to explore first. Pick any area that seems relevant and explain your reasoning. There's no single correct starting point.

In an interviewer-led case, the interviewer directs you to specific questions or areas. They control the flow and will tell you what to work on next.

Either way, you're now in the meat of the case interview.

Step 5: Solve quantitative problems

Expect math. You might estimate a market size, calculate profitability, or interpret charts and graphs.

Before crunching any numbers, lay out your approach. Walk the interviewer through the structure of your calculation. If they approve your method, the rest is just arithmetic.

Talk through your math out loud. This helps the interviewer follow your work and allows them to catch mistakes or offer guidance if you get stuck.

After completing a calculation, connect your answer back to the case objective. What does this number mean for the recommendation you're building?

Step 6: Answer qualitative questions

Not everything in a case is quantitative. You'll also face open-ended questions that test your business judgment.

You might be asked to brainstorm ideas, evaluate risks, or give your opinion on a strategic issue. Structure your answers even when the question is qualitative. Organize your ideas into clear categories rather than listing thoughts randomly.

Always tie your answer back to the case objective. How does this insight help you solve the overall problem?

Step 7: Deliver your recommendation

The interviewer will ask for your final recommendation. Take a moment to review your notes before speaking.

Structure your closing clearly. State your recommendation upfront. Then provide the two or three strongest reasons that support it. Finally, mention what next steps you'd take if you had more time.

Be decisive. Don't waffle between options. As long as your recommendation is supported by evidence from the case, the interviewer will accept it.

How Case Interviews are Evaluated

Understanding how interviewers actually score candidates gives you a major advantage.

The five dimensions interviewers assess

Recall that interviewers evaluate you across five key areas: logical, structured thinking, analytical problem solving, business acumen, and communication skills. Each one gets a score. Your interviewers will also rank you against all of the other candidates that they interviewed that day.

How scoring works

Most firms use a four-point scale.

- A score of “4” means you definitely passed

- “3” means you barely passed

- “2” means you barely missed the bar

- “1” means you definitely should not pass

Each interviewer gives you scores across the five dimensions plus an overall score. Since you'll have two to four interviews per round, you end up with multiple overall scores.

How decisions get made

At the end of the interview day, all interviewers gather to decide which candidates move forward.

Two fours? You're definitely advancing.

A four and a three? You'll likely move on unless there's unusually strong competition.

Any ones? You're out.

Here's where it gets interesting. Candidates who receive a four and a two often advance over candidates who receive two threes. That seems counterintuitive, but there's logic behind it.

A two might represent an off performance. Maybe the candidate was nervous or had a tough interviewer. But that four shows they have the potential to excel.

Two threes, on the other hand, suggest consistent mediocrity. The candidate never demonstrated top-tier potential.

Case Interview Frameworks

A framework is simply a tool for breaking down complex problems into smaller, manageable pieces. Think of it as organized brainstorming. You identify the key questions you need to answer, group similar questions together, and create a roadmap for solving the case.

The best frameworks are tailored to the specific case you're solving. Memorized, cookie-cutter frameworks make you look like you can't think critically. Interviewers spot them immediately.

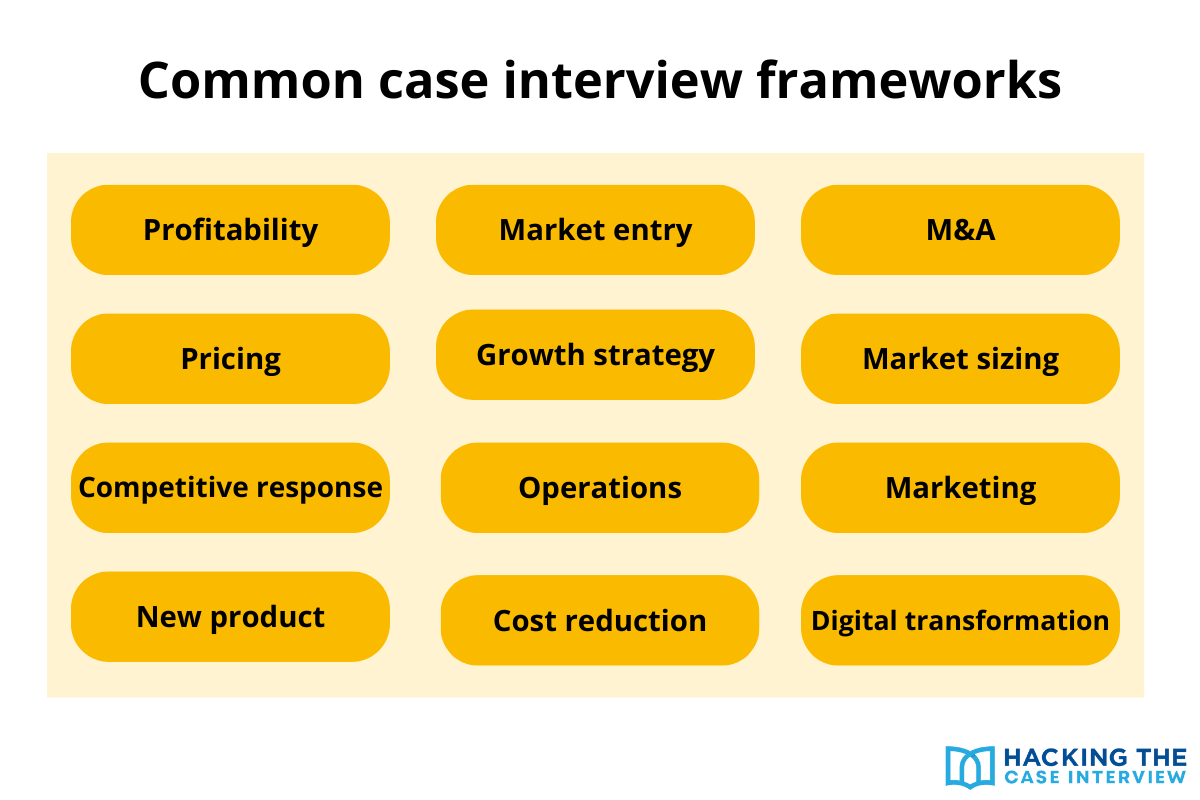

That said, understanding common framework structures helps you build better custom frameworks on the fly. Below are the most common types of case interview frameworks you'll encounter.

Profitability Framework

Profitability cases are the most common type you'll see in first-round interviews. A typical prompt sounds like this: "An electric car manufacturer has recently seen declining profits. What should they do?"

Profitability frameworks work in two stages. First, you identify what's driving the profit change quantitatively. Then you figure out why it's happening qualitatively.

The quantitative side

Start with the basic formula: Profit = Revenue minus Costs.

Revenue breaks down into price times quantity. If revenue is declining, is it because you're selling fewer units? Or because you're selling at lower prices?

If it's quantity, dig deeper. Is the drop concentrated in a specific product line, geography, or customer segment?

Costs break into variable costs and fixed costs.

- Variable costs change with production volume. Raw materials, hourly labor, and shipping are typical examples

- Fixed costs stay constant regardless of output. Rent, salaries, and insurance fall here

Which cost categories have increased?

The qualitative side

Once you know what's happening numerically, figure out why.

- Look at customers: Have their needs or preferences changed? Are they buying differently than before? Have their perceptions of your company shifted?

- Look at competitors: Have new players entered the market? Have existing competitors made strategic moves? Are they experiencing the same profitability issues?

- Look at the broader market: Are there new technologies disrupting the industry? Have regulations changed? Are there economic trends affecting demand?

Once you understand both the what and the why, you can brainstorm solutions and prioritize based on impact and ease of implementation.

Market Entry Framework

Market entry cases are the second most common type. A classic example: "Coca-Cola is considering entering the beer market in the United States. Should they enter?"

For you to recommend entering a market, four statements generally need to be true.

- The market is attractive. Consider the market size, growth rate, and average profit margins. Are substitutes readily available? How much power do suppliers and buyers have? How high are barriers to entry?

- Competition is manageable. How many players are there? How much market share does each hold? Do competitors have significant competitive advantages or differentiation? Is there room to capture meaningful share?

- The company has the capabilities to compete. Are there significant capability gaps? Can the company leverage existing synergies? Does it have the right distribution channels and supplier relationships? Is it in a strong enough financial position to make the investment?

- The entry will be profitable. What are the expected revenues and costs? How long will it take to break even? What's the expected return on investment?

Notice the logical flow. You start with whether the market is worth entering at all. Then you assess whether you can actually win there. Then you confirm you can execute. Finally, you verify the numbers work out.

If you're leaning toward recommending entry, think through the entry strategy.

Should the company enter immediately or wait? Should it target the entire market or start with a subset? Should it build capabilities internally, acquire a company, or partner with someone?

If you're leaning against entry, consider alternatives. Is there another market that might be more attractive? Are there better uses for the capital?

Merger & Acquisition Framework

M&A cases come in two main flavors. Either a company is acquiring another company for strategic reasons or a private equity firm is acquiring a company as an investment.

Strategic acquirers might be looking to access new customers, gain intellectual property, realize synergies, acquire talent, remove a competitor, or diversify revenue sources.

Private equity acquirers are typically looking to generate high returns by improving operations, driving growth, and eventually selling the company for more than they paid.

Either way, four statements need to be true for you to recommend the acquisition.

- The target's market is attractive. Assess market size, growth rate, profit margins, and competitive dynamics. You're not just buying a company, you're buying exposure to its market

- The target company is attractive. Is it profitable? How fast is it growing? Does it have competitive advantages or meaningful differentiation?

- The acquisition generates meaningful synergies. Revenue synergies might include access to new customer segments, cross-selling opportunities, or new distribution channels. Cost synergies might include eliminating redundancies, consolidating functions, or increasing buying power

- The price is right. Is the acquisition price fair? What's the expected return on investment? How long until breakeven?

If you're leaning toward recommending the deal, explore the risks. How will competitors react? Will integration be difficult? Could the acquisition hurt existing customers?

If you're leaning against, consider what alternatives exist. Is there a different acquisition target? Are there better uses for the capital?

Pricing Framework

Pricing cases ask you to determine the optimal price for a product or service. There are three fundamental ways to approach pricing.

- Pricing based on costs sets your floor. Calculate all costs to produce and deliver the product, then add a profit margin. You can't sustainably price below your costs

- Pricing based on value sets your ceiling. Identify all benefits the product provides to customers and quantify their value. This total represents the customer's maximum willingness to pay. You can't price above this or no one will buy

- Pricing based on competition helps you find the right spot between floor and ceiling. Look at what competitors charge for similar products and the value their products provide. The difference between competitor price and competitor value is the surplus customers get from buying the competitor's product. To win customers, you need to offer at least that much surplus

Most pricing answers involve a mix of all three approaches. Start with costs to establish the minimum. Understand value to establish the maximum. Use competitive analysis to find the sweet spot.

Also consider additional factors. Can you cross-sell or up-sell other products? Should you offer different versions at different price points? How will competitors respond to your pricing decisions?

Growth Strategy Framework

Growth strategy cases ask how a company can increase revenues, profits, customers, or some other metric. A typical prompt: "Walmart wants to grow after years of flat performance. What should they do?"

Think about growth through two major categories.

Organic growth comes from internal efforts. This can be through existing revenue sources or new revenue sources:

- Growing existing revenue sources means selling more of what you already sell. You might improve products, decrease prices, sell through new channels, target new customer segments, expand geographically, or invest more in marketing and sales

- Growing through new revenue sources means launching new products or services

Inorganic growth comes from external actions. You can acquire another company, form a joint venture, or enter a partnership:

- Acquisitions give you immediate revenue and full control, but they're expensive and integration can be challenging

- Joint ventures let you share resources and risk with a partner, but require coordination and you don't have full control

- Partnerships are typically cheaper and faster than joint ventures, but offer less control and it takes time to generate revenue

When solving growth cases, start by clarifying what metric the company wants to grow and by how much. Then systematically evaluate organic options before moving to inorganic ones. Prioritize opportunities based on impact, feasibility, and cost.

Market Sizing Framework

Market sizing questions ask you to estimate the size of a particular market or figure. They test your ability to structure problems, make reasonable assumptions, and do quick math.

There are two main approaches.

- Top-down starts with a large number and breaks it down

- Example: To estimate the toothbrush market in the US, you might start with the population (320 million), estimate what percentage brush their teeth (90%), estimate what percentage use regular toothbrushes versus electric (75%), estimate how many toothbrushes each person buys per year (10), and multiply by average price ($2)

- Bottom-up starts small and builds up

- Example: For the same question, you might start with one person, calculate their annual toothbrush spending, then scale up to the relevant population

Either approach works. Pick whichever feels easier for the specific question.

Some tips for market sizing:

- Use round numbers to keep math manageable

- Segment your population when different groups have different behaviors

- Sense check your answer against benchmarks you know

- And always think about what your answer implies for the broader case

Competitive Response Framework

Competitive response cases ask how a company should react when a competitor makes a strategic move. Maybe a competitor has slashed prices, launched a new product, or entered your market.

Structure your response around three main questions.

- What is the competitor doing and why? Understand the competitive move in detail. What are they hoping to achieve? Is this a rational strategic move or a desperate gamble?

- What is the impact on your client? How does this affect revenues? Costs? Market share? Customer perception? Is the impact concentrated in certain segments or geographies?

- What are the response options? You generally have four choices: do nothing, match the competitor's move, differentiate further, or counterattack in a different area

Doing nothing makes sense if the competitive threat is minor or temporary. Matching works when you can't differentiate and need to stay competitive. Differentiating works when you can offer something the competitor can't. Counterattacking means responding in a different arena where you have an advantage.

Evaluate each option based on likely effectiveness, cost, and risk. Consider how the competitor might respond to your response.

Operations Framework

Operations cases focus on improving how a company produces goods or delivers services. They tend to be more quantitative than strategy cases.

There are four common types.

1. Production optimization

This type asks how to increase output. Know two key formulas:

- Output = Rate x Time

- Utilization = Output / Maximum Output

You can increase production by improving the rate, increasing utilization, or adding capacity. Generally, try to optimize what you have before adding new capacity.

2. Process improvement

This type asks how to make a process better. Break the process into distinct steps. For each step, assess:

- The people (do you have enough? are they trained?)

- The process (are the right steps being performed?)

- The technology (is it being used effectively?)

Identify bottlenecks and prioritize improvements based on impact.

3. Cost cutting

This type asks how to reduce expenses. Break costs into components, identify which expenses are business-critical versus discretionary, and systematically evaluate where you can cut without damaging the business. Start with the largest discretionary items and work down.

4. Forecasting and capacity planning

This type asks how much to produce or hold in inventory. Estimate customer demand, understand the costs of having too much versus too little, and find the optimal balance.

Marketing Framework

Marketing cases ask how to position, price, promote, or distribute a product. The classic marketing framework is 5 C's + STP + 4 P's.

The 5 C's help you understand the situation before making decisions. They stand for:

- Company (products, advantages, goals, brand)

- Collaborators (suppliers, partners, distributors)

- Customers (needs, preferences, behaviors)

- Competitors (strengths, weaknesses, strategies)

- Context (regulations, economic trends, technology)

STP helps you decide who to target.

- Segmentation divides the market into distinct groups with different needs

- Targeting evaluates which segment to focus on based on size, growth, profitability, and fit

- Positioning defines how you want customers to perceive your product relative to competitors.

The 4 P's help you develop your strategy.

- Product is what you're selling and its features

- Place is where and how customers can buy it

- Promotion is how you'll spread the word

- Price is what you'll charge.

For most marketing cases, you won't use all of these elements. Pick the pieces most relevant to the question at hand and build a tailored framework.

New Product Framework

New product cases ask whether a company should launch a new product or service. They are quite similar to market entry cases.

For you to recommend launching, four things need to be true.

- The product targets an attractive market segment. How large is the segment? How fast is it growing? What are profit margins like?

- The product meets customer needs and beats competitors. Does it solve a real problem? How does it compare to what's already available? What makes it differentiated?

- The company can successfully launch it. Does the company have the technical capabilities? The distribution channels? The marketing muscle? The financial resources?

- Launching will be profitable. What are expected revenues and costs? How long until breakeven? Does the return justify the risk?

If you recommend launching, think through the go-to-market strategy. How should the product be priced? Where should it be sold? How should it be promoted?

Cost Reduction Framework

Cost reduction cases ask you to help a company cut expenses. The basic premise is simple: Profit = Revenue minus Costs.

If you can't grow revenue, cutting costs improves profitability.

Fixed versus variable costs is the most basic segmentation. Fixed costs like rent and salaries are harder to cut without major changes. Variable costs like materials and hourly labor can often be reduced through efficiency or negotiation.

Value chain analysis breaks down all company activities to identify where costs concentrate. Primary activities include logistics, operations, marketing, and service. Support activities include procurement, technology, HR, and administration.

Functional breakdown segments costs by department: R&D, manufacturing, sales and marketing, general and administrative.

Process-based approach mirrors how consultants actually work. Segment and prioritize costs, benchmark internally and externally, identify process improvements, and calculate costs and benefits.

When solving cost reduction cases, don't cut everything equally. Identify business-critical expenses that can't be touched, then focus on the largest discretionary items. Prioritize based on impact, feasibility, and risk to the business.

Digital Transformation Framework

Digital transformation cases ask how a company can use technology to improve its business. These cases are becoming more common as technology consulting grows.

Understand the business problem first. Don't jump to technology solutions. Clarify what challenge the company faces, what success looks like, and why transformation is needed now.

- Assess current state: What technology does the company use today? What are their technical capabilities? What's their digital maturity? What are the biggest pain points?

- Evaluate technology options: What solutions exist? Which best fit the company's needs? What are the costs, benefits, risks, and limitations of each?

- Analyze implementation feasibility: Does the company have the talent? What's the timeline? What will it cost? What organizational changes are required?

- Consider change management: Digital transformations fail more often because of people than technology. How will this affect employees? Who might resist? How will you train people?

- Evaluate expected impact: What are the expected cost savings or revenue gains? What's the payback period? What competitive advantage is gained?

The build-buy-partner decision often comes up. Building in-house gives full control but is expensive and slow. Buying existing solutions is faster but less customized. Partnering shares costs and risk but reduces control.

For most digital transformation cases, recommend a phased rollout rather than a risky "big bang" launch. Pilot with a small group, expand after refinement, scale broadly, then optimize continuously.

Case Interview Math

Case math shows up in every single case interview. If you can't handle the quantitative side quickly and accurately, you won't pass.

The good news? Case interview math is basic. You won't need calculus or advanced statistics. You will need to add, subtract, multiply, and divide with confidence. You'll need to work with percentages, estimate market sizes, and apply simple business formulas.

The challenge isn't the complexity of the math. It's doing straightforward calculations under pressure without making careless mistakes.

Essential Case Interview Math Concepts

Before diving into formulas, make sure you're comfortable with the fundamental math concepts that come up repeatedly.

Fractions

You should be able to simplify, add, subtract, multiply, and divide fractions without hesitation:

- To add or subtract fractions, find a common denominator

- To multiply fractions, multiply the numerators together and the denominators together

- To divide fractions, flip the second fraction and multiply

Decimals

Know how to add, subtract, multiply, and divide decimals. Pay attention to decimal placement since shifting the decimal point is the most common source of errors.

Also, be comfortable with scientific notation.

Percentages

Percentages come up constantly. A percentage is simply a number expressed out of 100.

The percent change formula is essential: Percent Change = (New Value minus Old Value) divided by Old Value.

Ratios and proportions

A ratio relates two numbers, like 2 to 3. A proportion equates two ratios, like 2/3 = 4/6.

Basic statistics

You need to know averages, weighted averages, and expected value.

- Average is the sum of values divided by the count. If competitors pay $10, $11, and $15 per hour for labor, the average is $36 divided by 3, which equals $12

- Weighted average accounts for different proportions. If laptops have a 20% margin and make up 70% of revenue, while services have a 60% margin and make up 30% of revenue, the overall margin is (20% times 70%) plus (60% times 30%), which equals 32%

- Expected value is the sum of possible outcomes multiplied by their probabilities. If there's a 40% chance of $120M in sales and a 60% chance of $40M, the expected value is (40% times $120M) plus (60% times $40M), which equals $72M

Linear equations

You should be able to solve simple equations with one unknown. If a company's revenues grew 60% to $100M, what were revenues last year?

Set up the equation: 1.6x = $100M.

Solve for x = $62.5M.

Case Interview Formulas

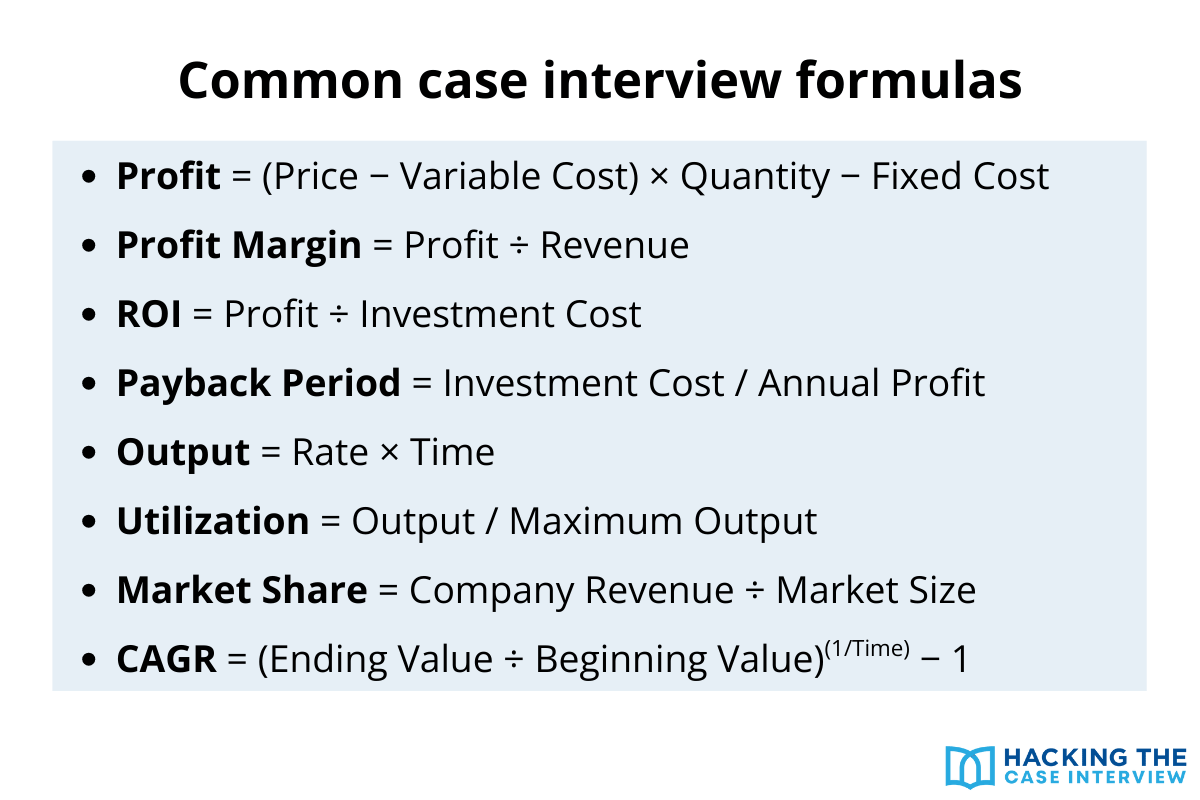

Memorize these case interview formulas. You'll use them repeatedly.

Profit formulas

- Revenue = Quantity x Price

- Costs = Variable Costs + Fixed Costs

- Profit = Revenue - Costs

- Profit = (Price - Variable Cost) x Quantity - Fixed Costs

- Contribution Margin = Price - Variable Cost

- Profit Margin = Profit / Revenue

- Breakeven is when Profit = 0

Investment formulas

- Return on Investment = Profit / Investment Cost

- Payback Period = Investment Cost / Annual Profit

Operations formulas

- Output = Rate x Time

- Utilization = Output / Maximum Output

Market share formulas

- Market Share = Company Revenue / Total Market Revenue

- Relative Market Share = Your Market Share / Largest Competitor's Market Share

Growth and finance formulas

- CAGR = (Ending Value / Beginning Value)(1 / Time Period) - 1

- Rule of 72 estimates doubling time. Divide 72 by the annual growth rate

Less common formulas

You may not need to know these, but it’s helpful to at least be familiar with them.

- Gross Profit = Sales - Cost of Goods Sold

- Operating Profit = Gross Profit - Operating Expenses - Depreciation - Amortization

- EBITDA = Operating Profit + Depreciation + Amortization

- Price Elasticity of Demand = Percent Change in Quantity / Percent Change in Price

Mental Math Strategies

Speed and accuracy matter equally. Use these strategies to get faster without sacrificing correctness.

1. Round numbers strategically

Use 320 million for the US population instead of 331 million. Round 199 times 17 to 200 times 17. The slight precision loss is worth the massive simplification.

Don't round so much that you signal discomfort with math. Occasional rounding helps. Constant rounding looks like avoidance.

2. Use abbreviations for large numbers

Write K for thousands, M for millions, B for billions, T for trillions. This prevents zero errors, which are the most common mistake.

Know the multiplication shortcuts:

- K times K equals M

- K times M equals B

- M times M equals T

3. Build percentages from components

Finding 10% is easy. Just move the decimal point one place left.

From there, build other percentages:

- 5% is half of 10%

- 1% is a tenth of 10%

- 15% is 10% plus 5%

4. Break down complex multiplications

Don't try to multiply 25 times 104 in one step. Break it down into simpler steps.

- 25 x 100 = 2,500

- 25 x 4 = 100

- 25 x 104 = 2,500 + 100 = 2,600

5. Simplify before dividing

To divide 244 by 8, first halve both numbers. 122 divided by 4.

You can then halve them again.

61 divided by 2 equals 30.5.

6. Memorize common conversions

Know these fraction-to-decimal conversions:

- 1/2 = 0.5

- 1/3 ≈ 0.33

- 1/4 = 0.25

- 1/5 = 0.2

- 1/8 = 0.125

- 2/3 ≈ 0.67

- 3/4 = 0.75

- 3/8 = 0.375

- 5/8 = 0.625

- 7/8 = 0.875

7. Sense check constantly

After each calculation, ask yourself if the answer is roughly the right magnitude.

For example, if you're multiplying 125 million by 24, your answer should be in the billions because 100 million times 20 is 2 billion.

Catching order-of-magnitude errors early prevents cascading mistakes.

8. Structure before calculating

Never dive into math without first laying out your approach. Tell the interviewer what you're going to calculate and how. This accomplishes two things.

First, it gets the interviewer's buy-in. If your approach is wrong, they can redirect you before you waste time.

Second, it creates a roadmap you can follow. When you know exactly what you're calculating and why, the math becomes mechanical.

9. Talk through your work

Narrate your calculations out loud. This helps the interviewer follow your thinking. It also helps you catch mistakes in real time.

If you go silent for two minutes and then announce a wrong answer, the interviewer has no idea where you went wrong. If you talk through each step, they can nudge you back on track when you slip.

10. Use a separate sheet for calculations

Keep your framework on one page and your math on another. This prevents your work from becoming a jumbled mess.

When calculations are organized, you can easily reference earlier numbers and spot errors.

Other Case Interview Skills

Beyond frameworks and math, several foundational skills separate average candidates from excellent ones. Master these and you'll handle any case thrown at you.

MECE

MECE stands for Mutually Exclusive, Collectively Exhaustive. It's the gold standard for structuring your thinking.

- Mutually exclusive means your categories don't overlap. Each item fits into exactly one category

- Collectively exhaustive means your categories cover everything. No possibilities are missing

Why MECE matters

MECE frameworks prevent duplicate work since categories don't overlap. They guarantee completeness since categories cover everything. And they produce better brainstorming since ideas get organized rather than randomly listed.

Examples of MECE

Dividing people into "dog lovers" and "cat lovers" is not MECE. Some people love both. Some love neither. There's overlap and there are gaps.

Dividing people by income brackets of under $40K, $40K to $80K, and over $80K is MECE. Everyone falls into exactly one bracket.

Other MECE structures:

- Revenue versus costs

- Internal versus external

- Fixed versus variable costs

- Organic versus inorganic growth

How to make frameworks MECE

The easiest approach is "X and Not X." By definition, everything is either X or not X.

Math formulas also work. Profit equals revenue minus costs. Revenue equals price times quantity. These relationships are inherently MECE.

When you can't enumerate everything, add "Other" as a catch-all. List the major components making up 80% of the whole, then group the rest into Other.

Hypothesis-Driven Approach

A hypothesis is an educated guess at the answer based on current information. Consulting firms use this approach on every project. You should use it in every case.

Why hypotheses matter

A case interview hypothesis focuses your effort on relevant questions. It helps you prioritize your limited time. It keeps you in the driver's seat during candidate-led cases. And it builds your recommendation since your hypothesis is essentially a draft answer.

Without a hypothesis, you guess randomly. You jump from customer demand to competition to costs with no connecting logic. You might stumble onto the answer, but it looks disorganized.

With a hypothesis, you proceed systematically. You think profits are declining due to costs, so you ask about costs. If costs are flat, you revise to focus on revenue. Each question gets you closer to the answer.

When to state your hypothesis

State it as early as possible, typically right after presenting your framework. "My initial hypothesis is that the company should enter this market because it's likely large and growing. Can we look at market size data first?"

If you lack enough information, say so and explain what you'd need to form a hypothesis. Then form one as soon as you get that information.

How specific should it be?

Early hypotheses are broad: "The profit decline is probably driven by decreasing revenue."

Late hypotheses are specific: "Revenue is declining because business class ticket sales in Asia dropped 30% due to increased competition."

When your hypothesis is wrong

Don't panic. Even excellent candidates get their initial hypothesis wrong half the time. Simply revise based on new information. "Since costs haven't changed, the decline must be revenue-driven. Let's look at revenue trends."

When your hypothesis is right

Keep refining. Being right means you're on the right track, not that the case is over. Drill deeper until you have a specific, actionable recommendation.

Drill-Down Analysis

Drill-down analysis starts broad and progressively narrows focus until you find the root cause.

How it works

Start at the highest level. Revenue is down. Break it into components. Is it price or volume? Volume. Break volume into components. Which product, region, or segment? Business travel.

Then investigate why.

Each level gets more specific. Keep drilling until you reach something actionable.

How to drill effectively

Decompose the problem into MECE categories. Look for the outlier at each level. If three regions are growing and one is declining, focus on the declining one.

Keep asking "why" at each level. Finding that business class sales are down isn't the answer. It's the starting point for asking why.

Know when to stop. Once you've identified something specific enough to act on, you've gone deep enough.

Business Acumen

Business acumen is your intuition for how businesses work. It helps you form better hypotheses, ask sharper questions, and propose realistic solutions.

Core concepts to understand

1. Understand how companies make money.

Revenue comes from selling products or services. Profit depends on the spread between price and cost. Growth can come from selling more, charging more, or entering new markets.

2. Understand competitive dynamics.

Companies compete on price, quality, convenience, brand, or some combination. Sustainable competitive advantages come from things competitors can't easily copy. Market structure affects profitability since fragmented markets with many competitors typically have lower margins than concentrated markets.

3. Understand common business challenges.

Declining profits usually stem from revenue problems, cost problems, or both. Growth stalls when markets mature or competition intensifies. Operations issues often involve bottlenecks, capacity constraints, or inefficiencies.

4. Understand basic strategy concepts.

Market entry decisions depend on market attractiveness, competitive position, and company capabilities. Pricing decisions balance cost coverage, competitive positioning, and value capture. Investment decisions compare expected returns to the cost of capital and alternative uses.

How to build business acumen

There are three main ways to build business acumen.

- Read business news regularly

- Study how different industries work

- Pay attention to the businesses you interact with daily

Why does Costco charge membership fees? Why do airlines oversell flights? Thinking about business logic behind every day experiences builds intuition.

Communication

Communication is how you convey your thinking. Brilliant insights don't count if you can't articulate them clearly.

1. Structure your communication

State the main point first, then support it. Instead of building up to your conclusion, lead with it.

Use signposting. "I'd like to explore three areas. Let me start with market attractiveness."

2. Number your points.

"There are three reasons this makes sense. First... Second... Third..."

3. Be concise

Say what you need to say and stop. Every sentence should either advance your analysis or answer a question the interviewer cares about.

4. Think out loud

Narrate what you're doing. "I'm calculating profit margin by dividing profit by revenue." Share your reasoning. "I want to focus on Asia first because that's where we saw the biggest decline."

This lets the interviewer follow your thinking and catch errors early.

5. Manage the interaction

Check in periodically. "Does this approach make sense?" If you're stuck, ask for help rather than spinning aimlessly. When you make a mistake, correct it without excessive apology.

Case Interview Examples with Solutions

McKinsey Case Interview Examples

- Electro-light (McKinsey)

- Beautify (McKinsey)

- GlobaPharm (McKinsey)

- Talbot Trucks (McKinsey)

- Diconsa (McKinsey)

- National Education (McKinsey)

- Conservation Forever (McKinsey)

Bain Case Interview Examples

BCG Case Interview Examples

Deloitte Case Interview Examples

- Finance Strategy: Federal Health Agency

- LeadAuto: Market Expansion

- Talent Management: Federal Civil Cargo Protection Bureau

- Business Strategy: Recreation Unlimited

- XFintech Inc. Ransomware Attack

- Data Exfiltration

- Applied AI, Automation, and the Future of Work

- Architecture Strategy: Federal Finance Agency

- Construction Delays: Project Analysis

- Industrial Warehouse Valuation

PwC/Strategy& Case Interview Examples

- Digital transformation at a large financial institution

- Exploring a healthcare expansion strategy *toggle to switch cases

- UK Grocery Retail (Strategy&) *scroll to page 24

Oliver Wyman Case Interview Examples

LEK Case Interview Examples

Accenture Case Interview Examples

EY-Parthenon Case Interview Examples

- No cases available as of right now

Kearney Case Interview Examples

Roland Berger Case Interview Examples

Case Interview Preparation Plan

In this section, we’ll cover exactly how to prepare for case interviews with three different case interview prep plans depending on your consulting recruiting timeline.

1-Week Case Interview Prep Plan

One week is tight, but you can still make meaningful progress if you focus on the essentials. This plan assumes you can dedicate four to six hours per day.

Day 1: Learn the fundamentals

Start with a structured course or book to understand how case interviews work. Learn the basic case types: profitability, market entry, pricing, and growth strategy. Understand the difference between candidate-led and interviewer-led formats. Don't try to memorize frameworks yet. Focus on understanding the underlying logic.

Day 2: Master framework building

Learn to build custom frameworks rather than memorizing rigid structures. Practice creating frameworks for ten different case prompts. Time yourself. You should be able to structure a case in 60 to 90 seconds. Your frameworks should be MECE and tailored to the specific question.

Day 3: Drill case math

Work through mental math drills until you're comfortable with percentages, growth rates, and large number multiplication and division. Practice the common formulas: profit, breakeven, ROI, market share. Do at least 30 math problems. Speed matters, but accuracy matters more.

Day 4: Practice full cases

Work through four to six full cases. Use a case book, online platform, or YouTube videos. For each case, pause before looking at the answer and try to solve it yourself. Practice speaking your answers out loud even if you're alone. Identify which parts of the case feel weakest.

Day 5: Live practice

Find a practice partner and do at least three live cases. Trade roles so you also practice giving cases. Live practice reveals weaknesses that solo practice misses. Focus on communication, pacing, and staying structured under pressure.

Day 6: Target your weaknesses

Spend the day on whatever felt hardest during Days 4 and 5. If math slowed you down, do more drills. If your frameworks felt generic, practice building more. If you struggled with synthesis, practice delivering recommendations. Do two more live cases focusing on improvement areas.

Day 7: Light review and rest

Review your notes and frameworks in the morning. Do one final practice case to build confidence. Then stop. Rest the afternoon before your interview. Cramming until the last minute increases anxiety and rarely helps.

What to expect with one week of prep: You'll have a solid foundation and can perform reasonably well. You won't be as polished as someone who prepared for months, but focused preparation beats scattered preparation every time.

1-Month Case Interview Prep Plan

One month gives you time to build real skill, not just familiarity. This plan assumes you can dedicate one to two hours per day on weekdays and more on weekends.

Week 1: Build your foundation

Complete a comprehensive case interview course or work through a full case interview book. Learn all major case types, common frameworks, and the overall interview process. Practice building custom frameworks for 20 different case prompts. Start mental math drills daily, spending 15 to 20 minutes per session.

Week 2: Develop case skills

Work through 10 to 15 full cases. Mix up case types so you see profitability, market entry, M&A, pricing, and operations cases. After each case, identify what went well and what didn't. Continue daily math practice.

Start practicing out loud. Even without a partner, verbalizing your thinking builds the communication muscle you'll need in interviews.

Week 3: Live practice and feedback

Shift focus to live practice. Aim for at least six live cases this week with practice partners. Find partners through forums, classmates, or colleagues also recruiting for consulting. Trade roles each session.

After each case, get specific feedback:

- What did you do well?

- Where did you lose structure?

- Did your math have errors?

- Was your recommendation clear?

Take notes and track patterns in feedback.

Consider one coaching session this week if budget allows. An experienced coach can identify blind spots partners might miss.

Week 4: Polish and refine

Continue live practice with four to six more cases. Focus on smooth delivery, confident communication, and clean synthesis.

Do lighter practice the last two days. Review your notes, but don't cram. Get good sleep before interview day.

What to expect with one month of prep: You'll be well-prepared and competitive with most candidates. Your frameworks will be solid, your math will be reliable, and you'll have enough case reps to handle surprises.

3-Month Case Interview Prep Plan

Three months allows you to build deep expertise and enter interviews with genuine confidence. This plan works well for candidates starting from scratch or those targeting the most competitive firms.

Month 1: Foundation and skill building

- Weeks 1-2: Complete a comprehensive case interview course. Learn all frameworks, case types, and methodologies. Build your mental math foundation with daily practice. Work through 10 to 15 solo cases to understand the mechanics

- Weeks 3-4: Increase case volume to 15 to 20 cases. Start live practice with partners, aiming for two to three sessions per week. Identify your weakest areas through feedback. Begin reading business news regularly to build commercial awareness

By the end of Month 1, you should be comfortable with all case types and have identified specific areas for improvement.

Month 2: Volume and refinement

- Weeks 5-6: Ramp up live practice to three to four sessions per week. Work through 20 more cases across all types. Focus on speed and efficiency. Your goal is solving cases smoothly without getting stuck. Continue daily math drills, pushing for faster calculations

- Weeks 7-8: Target your weak spots intensively. If certain case types give you trouble, drill them specifically. If your recommendations lack impact, practice synthesis repeatedly. Get coaching feedback if possible to ensure you're improving in the right direction

By the end of Month 2, you should be performing consistently well across case types with reliable math and clear communication.

Month 3: Mastery and confidence

- Weeks 9-10: Continue live practice at three sessions per week. Focus on handling curveballs, unusual case types, and stress scenarios. Practice cases in conditions that simulate real interviews: timed, with strangers, early in the morning

- Weeks 11-12: Maintain skills without burning out. Reduce to two live practice sessions per week. Review all your notes and frameworks. Do final preparation for behavioral questions and firm-specific research

What to expect with three months of prep: You'll enter interviews as a top-tier candidate. Your frameworks will feel natural, your math will be fast and accurate, and you'll have seen enough cases that few things surprise you. Three months of consistent preparation puts you in the top 10% of candidates.

First Round vs. Final Round Case Interviews

Consulting firms typically conduct two rounds of interviews before extending offers. Each round serves a different purpose and requires slightly different preparation.

First Round Interviews

Format and logistics

Consulting first round interviews typically consist of two back-to-back interviews lasting 30 to 60 minutes each. Students usually interview on campus or nearby. Working professionals interview at the office they're applying to. Some firms conduct first rounds over phone or video.

What's being tested

Think of first rounds as a filter. The firm wants to identify strong candidates and remove weak ones quickly.

Case performance is by far the most important factor. You need to demonstrate structure, problem solving, business acumen, and communication. Unless your personality raises red flags, fit won't prevent you from advancing. Be polite and friendly, and you'll pass the fit component.

What to expect

Cases in first rounds are predictable. Expect profitability cases and market entry cases with clear structures.

The interview typically flows like this: small talk, one or two fit questions, the case, and your questions for the interviewer. Fit questions take about 5 to 10 minutes. The case takes the rest of the time.

Final Round Interviews

Format and logistics

Consulting final round interviews are longer and more intense. Expect three back-to-back interviews lasting 40 to 60 minutes each. Some firms have only two interviews while others have four.

Final rounds almost always take place at the office you're applying to. Your interviewers will be principals and partners who could become your supervisors or colleagues.

What's being tested

Final rounds are a selection process, not just a filter. Each office has a specific number of spots to fill and will extend offers to the best candidates.

Passing cases is still required. But fit becomes significantly more important. Your interviewers have a personal stake in who joins their office. They're asking themselves two questions:

- Can I see this person as a future consultant?

- Would I want this person on my team?

Both answers need to be yes for you to get an offer.

One of your interviews will focus heavily on fit. The interviewer may spend more than half the time on behavioral questions, leaving only a short mini-case or no case at all.

Different case styles

Final round cases are less predictable than first rounds. You'll see a wider variety of case types including pricing, growth strategy, M&A, competitive response, and operational improvement.

You may also encounter two new case styles.

1. Conversational cases

These feel more like brainstorming discussions than structured cases. The interviewer gives you a problem and asks for your thoughts. The conversation flows naturally based on your ideas.

There's no clear path or right answer. Structure your thinking out loud even when the format feels informal.

2. Stress cases

These put you under intentional pressure. The interviewer may be hostile, cut off your thinking time, tell you you're wrong, or attack reasonable answers.

Stay calm. Know it's intentional.

Talk through your thoughts out loud if you're not given time to think. Acknowledge feedback and keep searching for better answers. Never directly attack the interviewer's points.

Case Interview Resources

Preparing for case interviews requires the right resources. Here's where to find quality practice materials, guidance, and support.

Books

Books provide structured frameworks and practice cases you can work through at your own pace. Three books dominate the case interview prep space.

- Hacking the Case Interview (Taylor Warfield): This is our top recommendation. Written by a former Bain manager and interviewer, it provides a modern, practical approach to case interviews. The frameworks are designed to be customized rather than memorized, which is exactly what interviewers want to see. The book covers everything from structuring to math to delivering recommendations, with clear examples throughout

- Case Interview Secrets (Victor Cheng): Offers solid content on hypothesis-driven problem solving. Cheng's emphasis on leading with a hypothesis and testing it throughout the case is valuable. However, the book is lengthy and some of the frameworks feel dated compared to what top firms expect today. It's worth reading if you have time, but you'll need to adapt the approach rather than follow it rigidly

- Case in Point (Marc Cosentino): Is one of the most widely used case interview books. It contains an extensive collection of frameworks covering nearly every case type imaginable. The problem is that interviewers have seen these frameworks thousands of times. Candidates who memorize Case in Point frameworks often come across as rigid and formulaic. The book can help you understand different case categories, but relying on it too heavily will hurt more than help

Books are best for building foundational knowledge. They're affordable and let you study on your own schedule. However, they can't replicate the interactive nature of real interviews, so combine book learning with live practice.

YouTube channels

YouTube offers free video content showing case interviews in action. Watching others solve cases helps you understand pacing, communication style, and what good looks like.

- Hacking the Case Interview posts case walkthroughs, framework explanations, and tips for specific firms. Videos cover everything from beginner basics to advanced techniques

- CaseCoach provides mock case interviews with detailed feedback. Watching candidates receive coaching helps you identify common mistakes

- Management Consulted covers case interviews, firm-specific advice, and consulting career topics. Their content ranges from interview prep to post-offer guidance

- IGotAnOffer features former McKinsey and BCG interviewers conducting mock cases. Their videos show realistic interview dynamics and include detailed feedback

- Firm Learning and MConsultingPrep offer additional case practice videos and framework explanations

Forums

Forums connect you with other candidates and people who've been through the process. They're valuable for peer practice, firm-specific insights, and staying current on recruiting timelines.

- Wall Street Oasis has an active consulting forum with discussions on specific firms, interview experiences, and recruiting advice. The community includes current consultants who share insider perspectives

- Reddit's r/consulting covers consulting careers broadly, including interview prep discussions. The subreddit r/MBA is useful if you're applying through business school, with threads on consulting recruiting

- Glassdoor and Blind contain interview reviews with questions candidates actually received. Search by firm and role to see what others experienced

- PrepLounge has a forum with discussions that cover case types, firm-specific prep, and finding practice partners

Online platforms and courses

Online platforms offer structured learning, practice cases, and sometimes live practice with other candidates. These are some of the best resources to prep for case interviews.

- Our case interview course is our top recommendation. This comprehensive course covers frameworks, math, business essentials, and practice cases in a streamlined format designed to get you interview-ready in days rather than months. It teaches you to build custom frameworks rather than memorize rigid structures. The math section alone can cut your calculation time in half while reducing errors. With a reported 82% offer rate among students, it delivers results efficiently while saving you 100+ hours of prep.

- PrepLounge provides a large case library and a matching system to find practice partners globally. The partner matching feature is genuinely useful if you don't have access to other candidates preparing for consulting. However, case quality varies since many are user-submitted, and the platform can feel overwhelming with too many options. The free tier is limited, and premium pricing adds up quickly.

- RocketBlocks provides drills for case math, framework building, and other specific skills. It's useful for targeted practice on weak areas, particularly mental math. The drill format helps build speed. However, it's narrow in scope and won't teach you how to solve full cases end-to-end. Think of it as a tool for sharpening specific skills rather than comprehensive prep.

- Management Consulted offers courses, case libraries, and firm-specific prep materials. Their content covers the full recruiting process from resume to offer. The breadth is impressive, but the depth on case interviews specifically isn't as strong as other resources. Some candidates find the volume of content difficult to navigate efficiently.

Coaching

If you need case interview help, case coaching provides personalized feedback from experienced consultants or former interviewers. It's the most expensive option but also the most targeted.

When coaching helps most

If you're struggling with specific weaknesses, preparing for final rounds, or want expert feedback on your performance. Coaching is also valuable if you don't have access to quality practice partners.

What to look for

Coaches with actual consulting and interviewing experience, clear methodology, and a track record of successful candidates. Former MBB consultants who conducted interviews can provide the most realistic feedback.

If you’d like to work with me, check out my one-on-one case coaching services. Sessions cover case practice, feedback, and personalized improvement plans.

Getting the most from coaching

Coaching is best used strategically. One or two sessions with quality feedback often provide more value than many sessions without clear direction. Combine coaching with self-study and peer practice for the most efficient preparation.

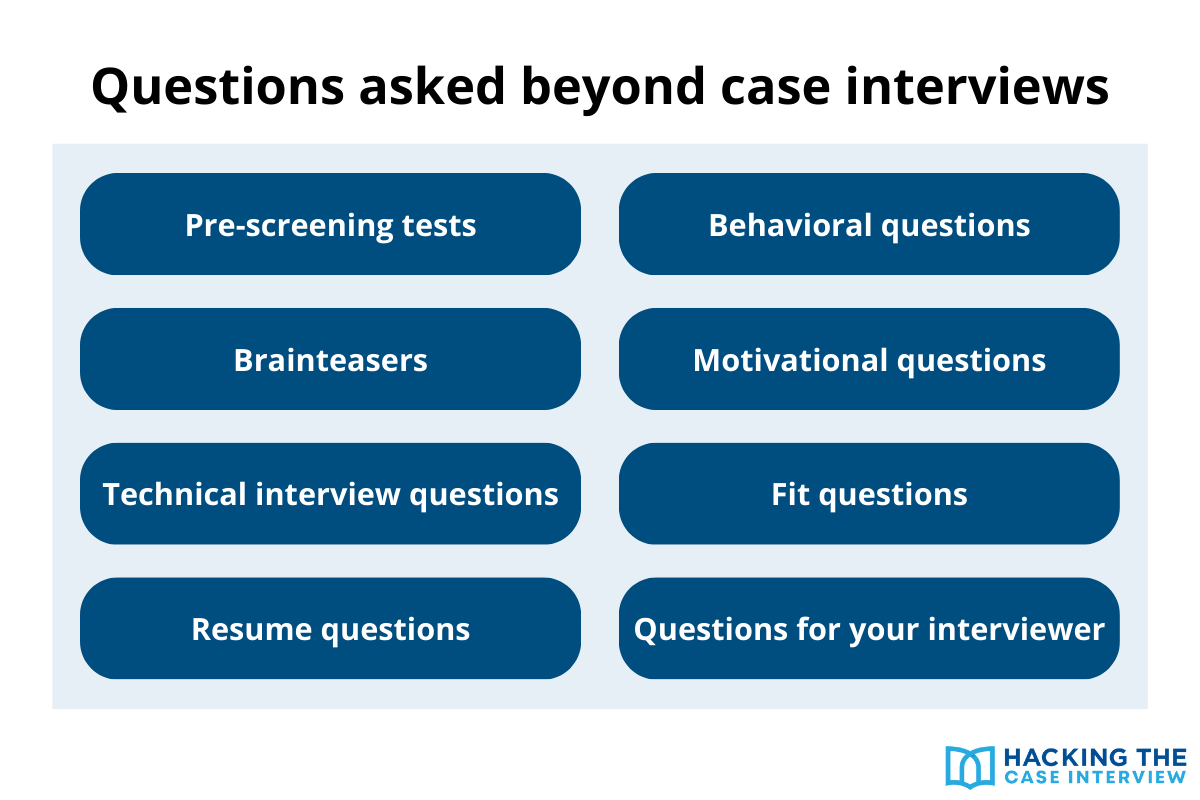

Beyond the Case Interview

Case interviews are the toughest part of consulting interviews, but they're not the only thing you'll face. Here's what else to prepare for in addition to case interview preparation.

Many candidates spend hundreds of hours preparing for case interviews, but neglect these other things as part of their consulting interview preparation.

Pre-Screening Tests and Assessments

Some firms require online assessments before your first interview.

McKinsey Solve is a 70-minute assessment with two ecology-themed exercises: ecosystem building and a case study called Redrock.

You'll create food chains, balance species populations, and answer analytical questions. The test measures critical thinking, decision making, and systems thinking. Both your final answers and your problem-solving process are scored.

BCG Pymetrics is a 20 to 30-minute assessment with 12 mini-games measuring cognitive traits like decision making, risk tolerance, attention, and learning. Games include memory exercises, balloon-pumping risk games, and money distribution fairness tasks.

BCG says it's used as an inclusion tool, not a filter, but strong performance adds a positive data point to your application.

Other firms use numerical reasoning tests. Oliver Wyman and LEK both have quantitative assessments.

You can't fully prepare for these like traditional tests, but familiarizing yourself with the format helps. Practice simulations exist online for both McKinsey Solve and BCG Pymetrics.

Brainteasers

Consulting brainteasers are puzzles designed to test creative thinking and problem solving under pressure. Top firms like McKinsey, BCG, and Bain rarely use them, but other firms like Accenture sometimes do.

Examples of brainteasers include:

- You are presented with two doors and two guards. One door leads to freedom, while the other leads to certain death. One guard always tells the truth, and the other always lies. You can ask only one question to one guard to determine which door leads to freedom. What question do you ask?

- You are in a room with three light switches, each connected to a different light bulb in another room. You cannot see the bulbs from where you are. You are told that each switch corresponds to one bulb, and you must determine which switch controls which bulb. You are only allowed to enter the room with the bulbs once. How do you figure it out?

- A group of people is standing in a line, each wearing either a black or white hat. They can only see the hats of the people in front of them, not their own or those behind them. Starting from the back of the line, each person must guess the color of their own hat. If they guess correctly, they are saved; otherwise, they are executed. The group is allowed to discuss a strategy before guessing begins. What strategy can they use to maximize their chances of survival?

Technical interview questions

Consulting technical interview questions only appear for specialized roles. Generalist consulting positions at strategy firms don't include them.

You'll encounter technical questions when applying for technology consulting, specialized practice areas like healthcare or financial services, or implementation roles. Questions might cover programming, data science, industry-specific knowledge, or established methodologies.

For example, McKinsey occasionally uses a Technical Expertise Interview for candidates with strong technical backgrounds.

Resume questions

"Walk me through your resume" or "Tell me about yourself" is asked at the start of most interviews. Interviewers use it to understand your background and assess communication skills.

Structure your answer in three parts: a strong opening that summarizes your expertise, brief highlights of your most impressive experiences working backward from the most recent, and a connection to why you're interested in consulting.

Some useful tips to follow:

- Keep it under two minutes

- Share accomplishments, not job descriptions

- Quantify results whenever possible

- End by asking if the interviewer wants to explore any area further

Behavioral questions

No consulting interview guide is complete without covering consulting behavioral interviews. Behavioral questions ask you to describe past experiences that demonstrate specific skills. Examples include:

- Tell me about a time you led a team

- Describe a situation where you handled conflict

- Give an example of a time you failed

Prepare six to eight diverse stories covering leadership, teamwork, problem solving, resilience, integrity, decision making, communication, and interpersonal skills. When asked a question, select the most relevant story from your prepared list.

Use the SPAR method to structure answers:

- Summary (one sentence overview)

- Problem (the challenge you faced)

- Action (what you specifically did)

- Result (the outcome and what you learned)

Keep answers to two to three minutes. Focus on your individual contributions, not what the team did. Quantify impact whenever possible.

Motivational questions

"Why consulting?" and "Why this firm?" assess your genuine interest in the career and company.

For both questions, use this structure:

- State that consulting or the firm is your top choice

- Provide three specific reasons why

- Reiterate your enthusiasm

Your reasons should be genuine and specific. Generic answers like "I want to solve business problems" won't distinguish you. Connect your specific experiences and interests to what consulting or the firm uniquely offers.

Fit questions

Fit questions assess whether you'd be a good colleague and cultural match. They include questions such as:

- What's your greatest strength?

- What's your greatest weakness?

- Where do you see yourself in five to ten years?

For strengths, pick something relevant to consulting and illustrate it with a brief example.

For weaknesses, be honest about a real weakness, explain what you've done to improve, and reflect on your progress. Saying "I work too hard" isn't credible.

For future aspirations, you don't need to claim you'll stay in consulting forever. Most consultants leave after a few years. Show ambition and explain how consulting helps you reach your goals.

Questions to ask at the end of the interview

To complete your consulting interview prep, make sure you prepare questions to ask your interviewer at the end of the interview.

Every interviewer saves time for your questions. This is your chance to connect personally and leave a positive impression.

Prioritize personal questions focused on the interviewer. People enjoy talking about themselves, and genuine interest builds rapport. Good questions include:

- What was your most challenging case?

- What do you enjoy most about your job?

- Looking back at your first year, what would you have done differently?

If personal questions don't fit the dynamic, ask intelligent questions about consulting or the firm. Examples include:

- What qualities make consultants most successful here?

- What advice would you give an incoming consultant?

Avoid questions you could easily answer with a Google search, questions that assume you'll get the job, and complex hypothetical questions.

Always have questions prepared. Saying "I don't have any questions" signals disinterest.

Your Next Step to a Consulting Offer

Ready to stop struggling and start landing consulting offers?

Enroll in my step-by-step case interview course:

- Get interview-ready in 7 days, not 6–8 weeks

- Create perfect frameworks in under 60 seconds

- Build business acumen in 2 hours, not 2 years

- Solve case math 2x faster with 80% fewer errors

- Practice with 20 cases covering 95% of case types

Join 3,000+ candidates who've landed offers at McKinsey, BCG, Bain, and other top firms. 82% of my students land consulting offers.

👉 Enroll Now